Imagine it’s payday at your school. Staff members are eagerly waiting for their salaries to hit their accounts, but behind the scenes, the payroll process is causing headaches. From miscalculations on teachers’ pensions to struggling with complex pay scales for temporary staff, the payroll system feels like a never-ending juggling act. Now, picture this: all the stress, confusion, and manual errors disappearing, replaced by an efficient, automated solution that gets it right every time. That’s exactly what Sirius Payroll 365 offers – user–friendly, cost-effective, and perhaps the best payroll software for schools and academies in the UK. If you’re tired of the payroll pain points that come with managing a school, it’s time to try this powerful yet affordable education payroll software solution that will make a difference.

The Payroll Challenges Faced by UK Schools

Before diving into the solution, let’s examine the key payroll pain points that schools across the UK face regularly. Whether it’s a primary school, secondary school, academy, or multi-academy trust, the common problems remain the same.

- Complex Payroll Structures

Schools employ a range of staff, each with different pay structures, from full-time teachers to part-time teaching assistants, supply staff, and contractors. Furthermore, the pay scales for teaching staff are often governed by national agreements, while support staff wages may vary depending on local authority pay scales. This creates a multi-layered payroll structure that requires constant attention and accurate record-keeping. Add in overtime, holiday entitlements, and different shift patterns, and it’s easy to see why payroll for schools can quickly become a nightmare.

- Teachers’ Pension Scheme (TPS) Contributions

One of the most critical payroll requirements for UK schools is managing the Teachers’ Pension Scheme (TPS). The scheme is not only mandatory for qualifying teachers, but it also involves specific contribution rates and a complex calculation process. Keeping track of eligible employees and making the necessary contributions can be time-consuming, especially when teachers join or leave the scheme. Manual errors here could lead to legal issues or hefty fines.

- Changes in Legislation and Regulations

UK schools must navigate a rapidly changing landscape of tax laws, national insurance rates, and pension requirements. For example, changes to income tax thresholds, pension contribution rates, and auto-enrolment rules must be reflected in the payroll system. Staying on top of these changes manually can lead to non-compliance, incorrect deductions, and even penalties.

- Payroll for Temporary and Supply Staff

Many schools rely on temporary or supply staff to cover teacher absences, special projects, or specific teaching needs. Managing the payroll for these staff members adds another layer of complexity. These workers may not have a regular pay schedule, and different tax codes or payment structures may apply. Correctly processing their pay can become cumbersome without the right tools in place.

- Time-Consuming Processes and Limited Resources

In many schools, payroll is handled by administrative staff who already have a full plate of duties. The task of inputting data manually, checking for errors, calculating deductions, and processing payments is often time-consuming and takes staff away from other important responsibilities. Given that many schools are operating on tight budgets, hiring a dedicated payroll officer or outsourcing the payroll function may not be an option. This makes it even more critical to have a solution that can reduce the time spent on payroll and ensure efficiency.

- Limited Budget for Payroll Solutions

School budgets are often stretched, and investing in complex, expensive payroll software may seem out of reach for many educational institutions. However, opting for cheaper, less suitable payroll solutions or relying on manual methods can create even greater long-term costs due to errors, inefficiencies, and compliance issues.

These are just a few of the reasons why schools need a payroll solution that is specifically designed to address their unique needs.

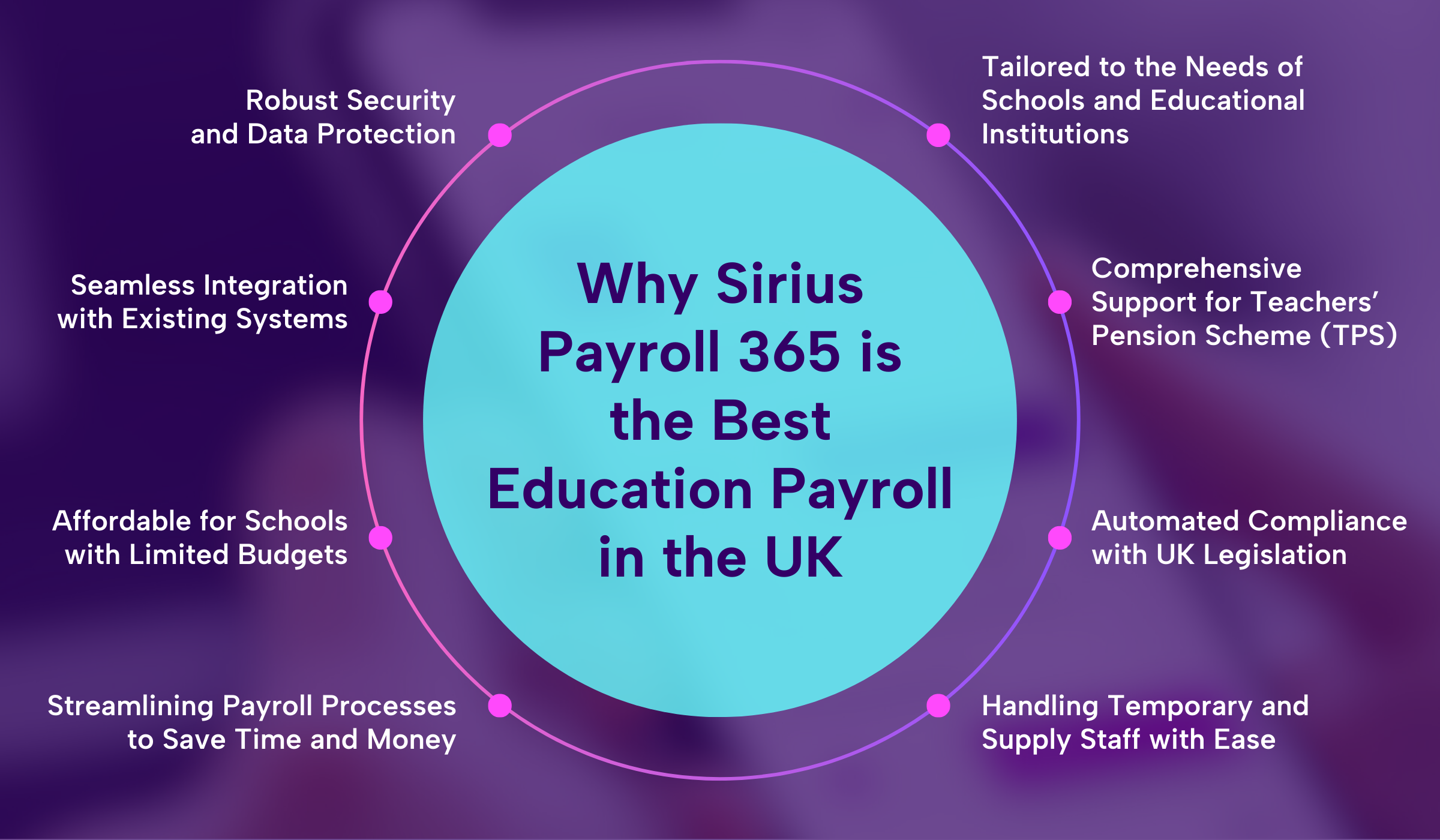

Enter Sirius Payroll 365: The Best Payroll Software for Schools in the UK

Amid these challenges, Sirius Payroll 365 is the solution that UK schools have been waiting for. Specially designed for educational institutions, this payroll software simplifies complex payroll tasks while ensuring compliance with the latest legislation. Let’s take a closer look at how Sirius Payroll 365 tackles the nuances of education payroll and why it’s the best payroll software for schools in the UK.

1. Tailored to the Payroll Needs of Schools and Educational Institutions

Unlike generic payroll systems, Sirius Payroll 365 is specifically tailored to meet the needs of the education sector. Whether you’re managing a primary school or a multi-academy trust, the system can handle the diverse range of payroll requirements that schools face. From teachers on national pay scales to support staff on local authority pay agreements, Sirius Payroll 365 ensures that every employee is paid accurately according to their contract.

The software is built to handle complex payroll structures such as full-time, part-time, supply, and temporary staff, while automatically applying the appropriate pay scales and tax codes. For schools, this means reducing the time spent checking calculations, and ensuring that everyone receives the right pay.

2. Comprehensive Support for Teachers’ Pension Scheme (TPS)

Managing pension contributions for teachers can be particularly challenging, given the complexity of the TPS. Thanks to People’s Pension integration, Sirius Payroll 365 takes the guesswork out of this task by automatically calculating TPS contributions, keeping track of qualifying service, and generating the necessary reports for submission to the pension scheme administrators. The software ensures that all eligible teachers are enrolled in the scheme and that contributions are deducted at the correct rates.

In addition, Sirius Payroll 365 can manage staff joining or leaving the TPS, ensuring that no one is missed and that contributions are paid accurately and on time.

3. Automated Compliance with UK Legislation

Sirius Payroll 365 keeps schools up to date with the ever-changing landscape of UK payroll legislation. The system automatically adjusts to changes in tax rates, National Insurance contributions, pension rates, and auto-enrolment rules. Schools no longer have to worry about missing a key update or manually implementing new tax rates – the software ensures compliance with the latest regulations in real-time.

For instance, Sirius Payroll 365 automatically adjusts for changes in income tax thresholds and National Insurance brackets, ensuring that teachers and support staff are taxed correctly. The software also manages auto-enrolment for pensions, reducing the administrative burden on schools and ensuring that they meet their obligations under UK law.

4. Handling Temporary and Supply Staff with Ease

Schools often face the challenge of managing the payroll for temporary or supply staff, who have irregular working hours or unique pay structures. With Sirius Payroll 365, this task becomes much easier. The software allows you to set up specific pay rules for temporary or supply staff, ensuring that they are paid according to their contract terms without any hassle. The system supports multiple pay types, including hourly rates, daily rates, and fixed-term contracts, so temporary staff are paid accurately every time.

By automating these processes, Sirius Payroll 365 reduces the chances of error, ensuring that all staff, whether permanent or temporary, are paid on time and correctly.

5. Streamlining Payroll Processes to Save Time and Money

One of the biggest benefits of Sirius Payroll 365 is its ability to save schools both time and money. The software automates routine tasks like calculating deductions, generating payslips, and submitting HMRC reports, so school administrators can focus on more strategic priorities. With its intuitive interface, the system reduces the need for manual data entry and makes payroll processing faster and more efficient.

By eliminating errors and ensuring that everything is processed correctly the first time, Sirius Payroll 365 helps schools avoid costly mistakes, penalties, and the frustration of reprocessing payroll. The time savings are significant, allowing staff to focus on other critical tasks without the constant worry of payroll issues.

6. Affordable for Schools with Limited Budgets

Cost is always a concern for schools, and Sirius Payroll 365 offers an affordable solution for educational institutions operating on tight budgets. The software provides a flexible pricing structure that caters to schools of all sizes, from small primary schools to large academies and multi-academy trusts. Sirius Payroll 365 ensures that schools can access powerful payroll software without exceeding their budget.

When schools choose Sirius Payroll 365, they are making a smart investment that will save them money in the long run by reducing administrative overheads, preventing costly errors, and ensuring compliance with payroll regulations.

7. Seamless Integration with Existing Systems

Sirius Payroll 365 integrates smoothly with existing school management and financial systems, making it easy to implement without disrupting other operations. The software works well with finance ERPs like Dynamics 365 Business Central and HR systems like Dynamics365 Human Resource, along with other accounting platforms, and student management software through custom APIs, ensuring that all payroll-related data is synchronised across different departments.

This integration reduces the time spent on manual data entry, reduces the chances of errors, and ensures that all departments are on the same page when it comes to payroll management.

8. Robust Security and Data Protection

With payroll data being highly sensitive, security is a top priority for Sirius Payroll 365. The software adheres to the highest security standards, ensuring that all employee data is protected and secure. The system is fully GDPR-compliant, so schools can rest assured that personal and financial data is being handled with the utmost care and confidentiality.

Conclusion: Sirius Payroll 365 – The Best Payroll Software for UK Schools

Whether you’re a small educational insititution or a multi-academy trust, choosing Sirius Payroll 365 means investing in the best payroll software for schools. It works seamlessly with your existing systems, offers robust security, and reduces the administrative burden on staff. If you’re ready to transform your school’s payroll system and experience the benefits of automation, compliance, and ease of use, Sirius Payroll 365 is the solution you’ve been searching for. Say goodbye to payroll headaches and hello to a more efficient and stress-free approach to managing staff payments. Get in touch with our experts today or book a free demo!