Are you looking for the best payroll software in the UK? Have manual payroll processes become time-consuming and error-prone for your small or medium-sized business (SMB)? Then perhaps it’s about time that you considered investing in a robust and scalable payroll solution. But how do you choose the best payroll solution for your UK SMB? What is the best payroll software in the UK marketplace? Let us explain.

What is the best payroll software for UK SMBs?

Payroll software is an essential tool that streamlines the process of compensating employees. It handles the calculation of wages, taxes, and deductions, making payroll management more efficient and less prone to errors. Additionally, it offers capabilities like report generation, tax compliance assistance, and self-service portals for employees.

For SMBs in the UK, adopting payroll software simplifies payment procedures and guarantees that employees are compensated accurately and punctually. This investment not only saves valuable time and money but also helps in avoiding expensive errors, making it indispensable for growing businesses.

But the question still remains – what is the best payroll software for UK SMBs? As it turns out, there isn’t a single best payroll software for all UK SMBs, and here’s why focusing on finding the best fit is more important:

- Varying Needs: SMBs come in all shapes and sizes, with diverse payroll requirements. A small startup with a handful of employees might prioritise affordability and ease of use, while a larger company with a complex pay structure (bonuses, commissions, etc.) might need advanced features like integrations and in-depth reporting.

- Scalability: A business that’s just starting out might not need all the bells and whistles, but they should choose software that can grow with them. Scalable payroll software allows you to add features and accommodate more employees as your business expands.

- Cost: Payroll software pricing can vary significantly depending on the features offered and the number of employees you have. Finding a cost-effective solution that meets your specific needs is crucial for maximising your return on investment.

- Functionality: Not all SMBs require the same functionalities. Some might need basic payroll processing, while others might benefit from features like expense management, leave tracking, or time and attendance tracking. Choosing software with features you’ll actually use avoids paying extra for functionalities you don’t need.

- Integration: Does the payroll software integrate with your existing accounting software or HR system? Seamless integration saves time and reduces errors by eliminating the need for manual data entry between different systems.

- Ease of Use: An overly complex payroll system can be frustrating and time-consuming, especially for SMBs with limited IT resources. User-friendly software with intuitive interfaces and readily available customer support is essential.

By considering these factors, you can effectively evaluate different payroll software options and find the one that best fits your UK SMB’s specific payroll requirements.

Here’s How to Choose the Best Payroll Software for UK SMBs

Selecting the right payroll software for your SMB in the UK can be challenging given the myriad of options available. To simplify this process, we’ve outlined key considerations that can guide you in making an informed decision that suits your specific business needs.

1. Identify Your Business Requirements

Begin by defining your business requirements clearly. Consider both non-negotiable needs and desirable features. Essential factors to evaluate include:

- Business Size: The number of employees on your payroll.

- Budget: Your allocated budget for payroll management.

- Employee Types: The presence of seasonal or temporary staff.

- Integration Needs: Compatibility with other software you use.

- Payroll Frequency: How often you run payroll cycles.

- Work Environment: Whether your workforce is remote, hybrid, or office-based.

- Compliance: Adherence to HMRC and UK tax regulations.

Understanding these elements will help you narrow down your choices to software that can handle your unique demands.

2. Assess Software Security

Security is a critical aspect of payroll software. Inquire about the security measures implemented by prospective software providers. Look for features such as:

- Role-Based Access: Adds an extra layer of security.

- Data Encryption: Protects sensitive information.

- Regular Security Audits: Ensures ongoing compliance and safety.

- Employee Training: Equips staff with knowledge on data protection.

Ensuring that your payroll software has robust security measures will help protect your business and employee data from potential breaches.

3. Ensure Software Accessibility

In the era of hybrid work, accessibility is paramount. Your payroll software should be accessible via cloud-based systems or mobile apps, allowing payroll staff to process payslips and manage employee information remotely, from any device. This ensures that your payroll process remains efficient and adaptable to various working arrangements.

4. Evaluate Support and Training

Consider the level of support and training offered by the software provider. It’s crucial to assess whether they provide:

- Onboarding Assistance: Helps you set up the system effectively.

- Ongoing Support: Available to troubleshoot issues as they arise.

- Training Resources: Equips your team with the necessary skills to use the software proficiently.

Comprehensive support can make a significant difference in how smoothly you can implement and use the software.

5. Test the Software Before Purchasing

Many payroll software providers offer free trials or demos. Take advantage of these opportunities to test the software’s functionality and user experience. This can help you determine if the software meets your specific needs and is user-friendly for your team.

6. Define Your Budget

Finally, establish a clear budget for your payroll software. Pricing can vary widely among providers, so it’s important to understand:

- Cost Structure: Whether pricing is based on the number of employees, features, or usage frequency.

- Value for Money: Ensure the software meets your requirements without unnecessary expenditure.

By aligning your budget with your business needs, you can find the best payroll software that offers the most value for your investment.

Choosing the best and right payroll software for your UK SMB involves careful consideration of your specific needs, security, accessibility, support, and budget. By taking the time to evaluate these factors and testing potential options, you can select a payroll solution that enhances your business operations and ensures compliance with HMRC.

Introducing Sirius Payroll 365

SiriusPayroll365 is a UK-designed solution built for seamless integration with Dynamics 365 Business Central and HR. It simplifies payroll management for small and medium-sized businesses, ensuring accuracy, streamlining processes, and guaranteeing compliance with HMRC regulations.

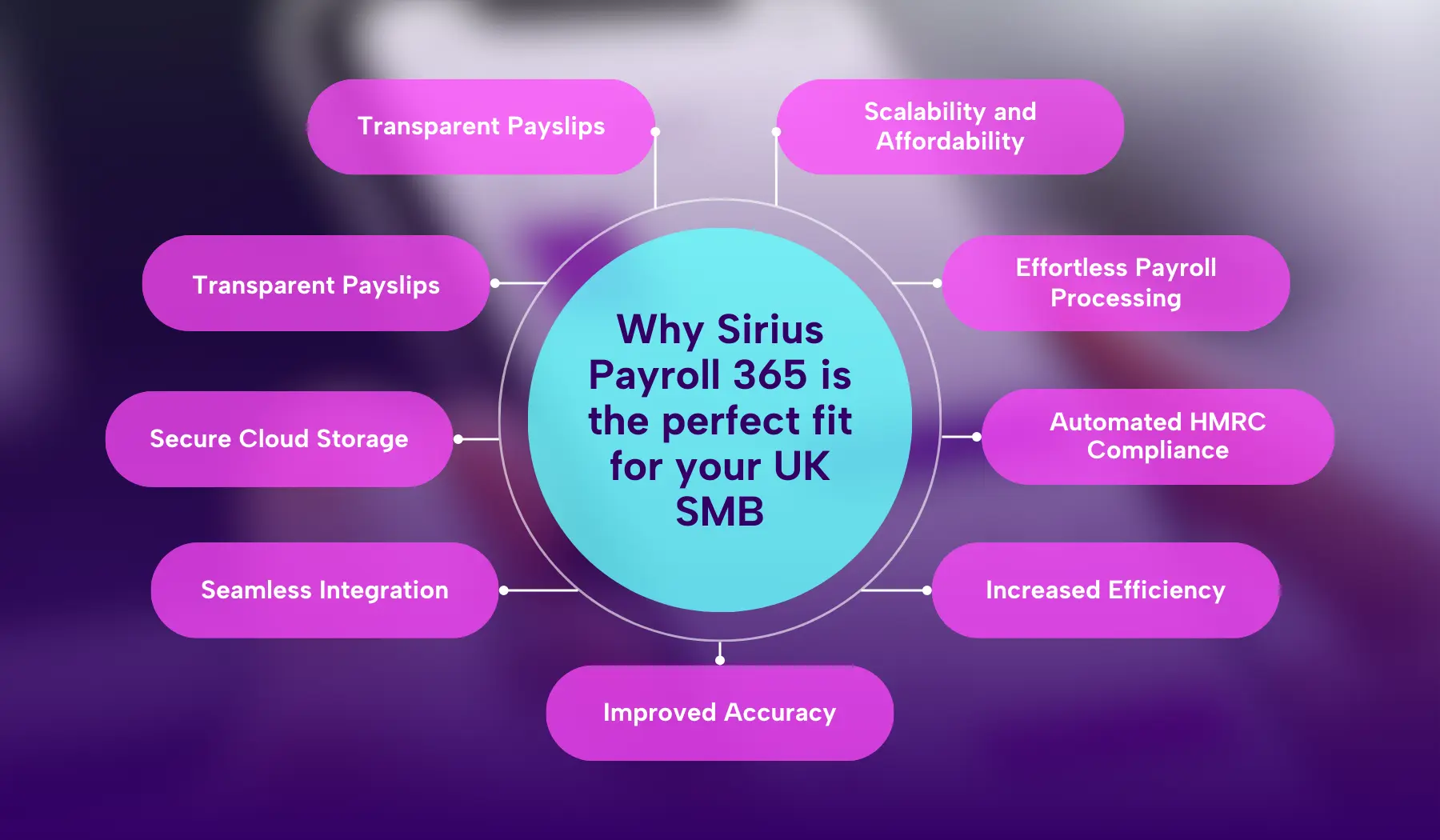

Why Sirius Payroll 365 is the perfect fit for your UK SMB

- Effortless Payroll Processing: Automate tasks, handle complex calculations (pensions, overtime, leave), and eliminate errors.

- Automated HMRC Compliance: Submit accurate reports (P11D, P60, FPS, EPS) and meet HMRC requirements with confidence.

- Increased Efficiency: Frees up HR and Finance teams to focus on strategic initiatives.

- Improved Accuracy: Ensures accurate payslips and reports for peace of mind and reduced risk of penalties.

- Seamless Integration: Connects seamlessly with Dynamics 365 for a unified platform managing payroll, HR, and financial data.

- Secure Cloud Storage: Leverage Microsoft Azure’s advanced security to ensure employee data privacy.

- Transparent Payslips: Generate and send password-protected payslips electronically, eliminating paper waste and improving confidentiality.

- Powerful Reporting: Track employee earnings, generate reports, and monitor your financial health with ease.

- Scalability and Affordability: Scales with your business and starts at just £1 per employee, per month (plus potential setup costs).

Sirius Payroll 365: Key Features and Capabilities

- Automated Calculations: Handles salaries, pensions, overtime, deductions, and year-to-date figures.

- HMRC-Recognised: Guarantees compliance with HMRC regulations and meets Real Time Information (RTI) requirements.

- The People’s Pension Integration: Disburse accurate and cost-effective pension payments.

- Unified Employee Data: Centralises payroll, HR, and financial data for easy access and management.

- Secure Cloud Storage: Stores employee data securely on the Microsoft Azure cloud platform.

- Online Payslips: Generates and distributes password-protected payslips electronically.

- Detailed Reporting: Provides comprehensive reports on employee earnings and financial health.

- Dynamics 365 Integration: Integrates seamlessly with Dynamics 365 Business Central and Dynamics 365 Human Resources for a unified platform.

- Multi-Currency & Multi-Company: Handles payroll across multiple companies and currencies with ease.

- Customisation Options: Tailors the app, BACS and pension exports, and timesheet imports to your needs.

- User-friendly Interface: Simplifies payroll processing with an intuitive design.

- Advanced Features: Offers payroll cost breakdown by dimension and data import/export capabilities.

Streamline Your UK SMB with Sirius Payroll 365

Don’t let manual payroll slow down your UK SMB? Free yourself from errors and endless calculations with Sirius Payroll 365, the all-in-one solution designed for seamless integration with Dynamics 365. Designed specifically for UK businesses, it saves you time and money, eliminates payroll errors, and ensures compliance so you can focus on what matters the most – growing your business. Contact us today to book a free demo!