In the fast-paced and competitive world of business management, financial oversight is paramount. Effective employee expense management not only enhances operational efficiency but also ensures financial control and compliance, two factors essential for long-term business sustainability. The right expense management software can be a game changer. It can streamline processes, reduce costly errors, and foster a more satisfied and engaged workforce. Let’s delve into 15 key features that characterise top-tier employee expense management software in the UK.

Managing expenses can be a daunting task for businesses of any size, often bogging down employees with manual tasks and overwhelming finance teams with mountains of receipts. But in today’s fast-paced world, advanced technology solutions have transformed expense management from a cumbersome process into an efficient and streamlined operation. Selecting the right system, however, requires more than just finding a tool that tracks spending—it’s about choosing one with key features that can drive productivity and ensure compliance.

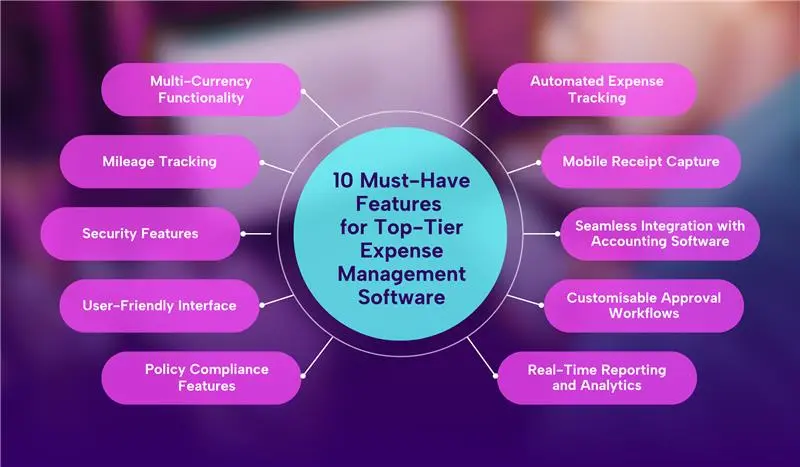

So, what should you look for in a top-tier expense management system? Here are 10 must-have features to consider.

1. Automated Expense Tracking

Automation is the lifeblood of modern business systems, and automated expense tracking is no exception. By leveraging this feature, the software eliminates tedious manual data entry. Expenses are digitally recorded,

automatically categorised, and processed in real-time—whether they’re swiped on a company card or entered through digital channels. This cuts down on human errors and speeds up the submission process.

Imagine a sales manager being able to focus on closing deals instead of worrying about logging every coffee shop receipt. The simplicity and precision brought by automation ensure that employees stay productive and managers have accurate data to make informed decisions.

2. Mobile Receipt Capture

Let’s face it: paperwork is the bane of any employee’s existence, especially when it comes to expense claims. But with mobile receipt capture, the entire process becomes effortless. Employees can snap a photo of their receipts on the go, instantly uploading them to the software. This feature reduces the headache of lost receipts and cuts down time spent on administrative tasks.

For example, a travelling consultant can photograph a meal receipt in Manchester and have it logged before dessert is served. This boosts efficiency, helps employees stay organised, and accelerates reimbursement timelines.

3. Seamless Integration with Accounting Software

In a world where siloed information can cost businesses time and money, integration is key. Top-tier expense management software integrates effortlessly with popular accounting platforms such as Dynamics 365, Xero, Sage, or QuickBooks. This integration enables real-time synchronisation between expense claims and financial records, allowing finance teams to reconcile transactions with ease.

For instance, an expense claim for a client dinner in London gets automatically reflected in the company’s financial records, reducing the chances of manual errors and making audits more straightforward.

4. Customisable Approval Workflows

Different organisations have varying levels of complexity in their expense approval processes. This is why customisable approval workflows are a crucial feature. Whether it’s a small business requiring one manager’s sign-off or a multinational company that needs a multi-level approval system, the software can be tailored accordingly.

A tech company, for example, might configure approvals so that all travel-related expenses above £500 need both department head and finance team authorisation, reducing unauthorised spending while ensuring quick approvals for low-risk claims.

5. Real-Time Reporting and Analytics

The ability to analyse expenses in real time can be a game-changer for financial planning. With intuitive dashboards and analytics tools, managers can spot spending patterns, forecast future budgets, and monitor departmental compliance with ease. For instance, a marketing director can instantly view how much the team has spent on conferences in the last quarter and adjust budgets accordingly.

Real-time data not only facilitates informed decision-making but also highlights inefficiencies or areas of concern before they spiral into bigger financial issues.

6. Policy Compliance Features

Expense policies are designed to protect company finances, but enforcing them manually is time-consuming. That’s where built-in policy compliance features shine. The software automatically flags non-compliant submissions, whether it’s a meal exceeding the per diem limit or a mileage claim that doesn’t align with the company’s policy.

This proactive approach reduces the administrative burden on managers while ensuring that employees stay within budgetary guidelines. Compliance becomes an effortless part of the workflow, ensuring financial discipline without the need for constant oversight.

7. User-Friendly Interface

A sophisticated system is only as good as its usability. Employees—especially those who aren’t tech-savvy—need a solution that’s intuitive and easy to navigate. Top-tier software ensures that the user experience (UX) is smooth from start to finish, whether on desktop or mobile.

Simple navigation menus, clear instructions, and an overall streamlined interface reduce the learning curve. For example, a new hire in HR should be able to submit an expense with minimal training, ensuring wide adoption across the organisation.

8. Security Features

In today’s data-driven world, security is non-negotiable. Top-tier expense management systems are fortified with state-of-the-art security features like data encryption, role-based access controls, and multi-factor authentication.

Given the sensitivity of financial and personal information being handled, these systems also comply with GDPR and other regulatory standards, protecting both the company and its employees from breaches. A finance director can confidently manage and approve expenses knowing that the software is secure and that the risk of unauthorised access is minimised.

9. Mileage Tracking

For employees who frequently travel, whether it’s by car or other means, accurate mileage tracking is essential. The software can automatically calculate distances based on GPS or map data, ensuring that employees are reimbursed fairly while maintaining compliance with company policies.

For instance, a salesperson travelling from Edinburgh to Birmingham can have their mileage tracked precisely, ensuring no disputes over reimbursements. This feature removes the guesswork and manual logging traditionally associated with mileage claims.

10. Multi-Currency Functionality

Global business operations are the norm rather than the exception, and multi-currency functionality is crucial for companies with international footprints. Expense management software that supports multi-currency conversions simplifies the process of logging and reconciling expenses in various currencies.

Whether an employee is attending a conference in Berlin or securing a business deal in Tokyo, foreign transactions are automatically converted into the home currency for seamless reporting, eliminating exchange rate guesswork.

Considering Expense Management Software? Let Us Help

Selecting the right employee expense management software is about more than just automating workflows—it’s about fostering financial discipline, enhancing employee satisfaction, and ensuring compliance with corporate policies. Whether it’s automated tracking, real-time analytics, or seamless integrations, these 10 key features equip businesses in the UK to manage expenses efficiently and scale effectively. By investing in the right solution, organisations can not only control costs but also empower their teams to work smarter, not harder, in today’s fast-moving business landscape.

At Sirius App, we understand that every business is unique. That’s why we offer personalised guidance to help you find the expense management solution that perfectly aligns with your specific needs. Our experts will assess your business operations, identify your pain points, and recommend the best features to optimise your expense management process. Get in touch with us today!